Visa Stock Analysis: Is Visa a Strong Opportunity Ahead of Q4 Earnings?

$325.48

28 Jan 2026, 19:25

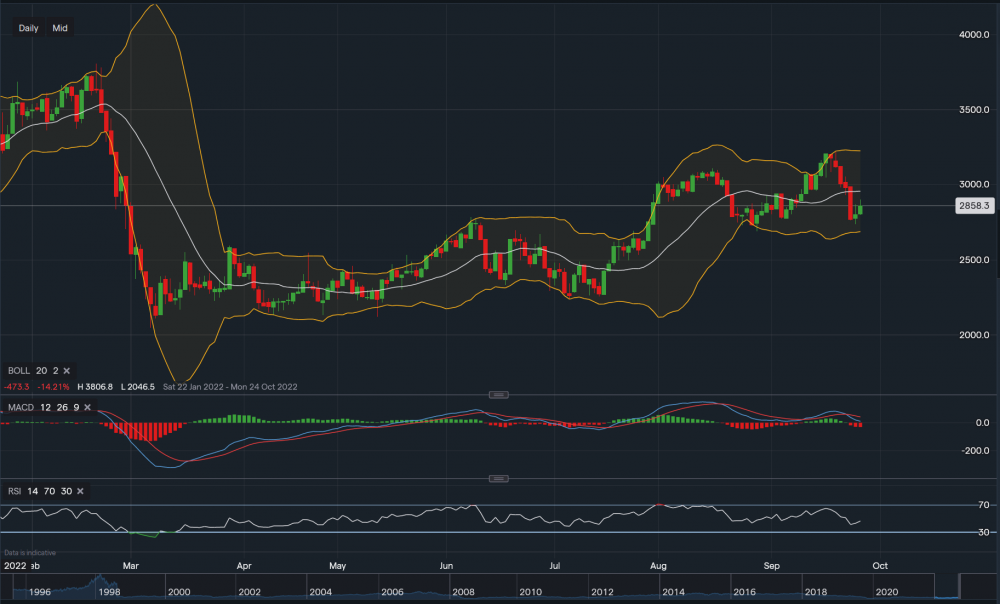

Looking at Renault from a technical aspect, the stock price sits at €28.47 as it opened higher today. The first support level sits €27.34, a break below this support would face a major support level at €26.88 matching the bottom Bollinger band. A slip below the major support level could see the stock plummet towards the low €20’s, losing all the gains since July. Towards the upside, first resistance level sits at €29.54 (middle Bollinger band) followed by further resistance at €30.81. Only a break above the €30.81 price could create opportunity for further recovery for Renault. Even though the share opened a little higher today, MACD is slightly negative but RSI reads 45 showing a neutral stance.