Visa Stock Analysis: Is Visa a Strong Opportunity Ahead of Q4 Earnings?

$325.48

28 Jan 2026, 19:25

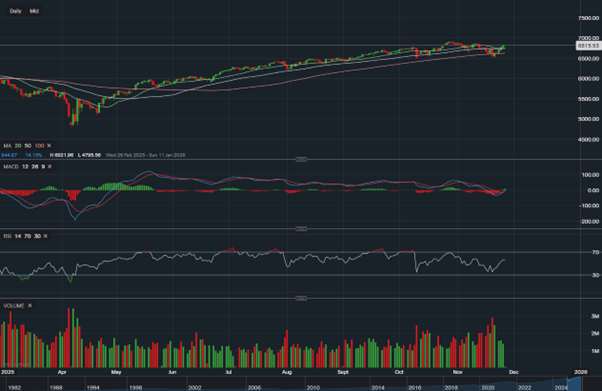

S&P 500: Will the Bullish Trend Continue After the Latest Pullback?

The S&P 500 recently experienced a pullback beginning on Wednesday 29 October, following a sharp rebound that came after the tariff scare on Friday 10 October. This price action has raised an important question: does this break of structure threaten the broader bullish trend, or will the S&P 500 continue its upward trajectory that has held since early April?

Technical Indicators Suggest Bullish Momentum May Hold

Several signals point towards continued strength:

These factors suggest the S&P 500 may still have room to climb if bullish conditions persist.

But Market Uncertainty Remains

Despite positive indicators, some signs call for caution:

These conditions indicate potential indecision in the market, meaning future gains may not be as aggressive as those seen earlier in the year.

Outlook for Traders and Investors

With recent price gains beginning to slow, the S&P 500 may either enter consolidation or possibly shift direction. For investors looking to avoid tying up capital during a period of uncertainty, it may be wise to wait for clearer confirmation before entering new positions.