Astrazeneca (AZN)- Technical & Fundamental Analysis

$12,416

Astrazeneca (AZN)- Technical & Fundamental Analysis

06 Nov 2025, 09:34

Unsplash.com

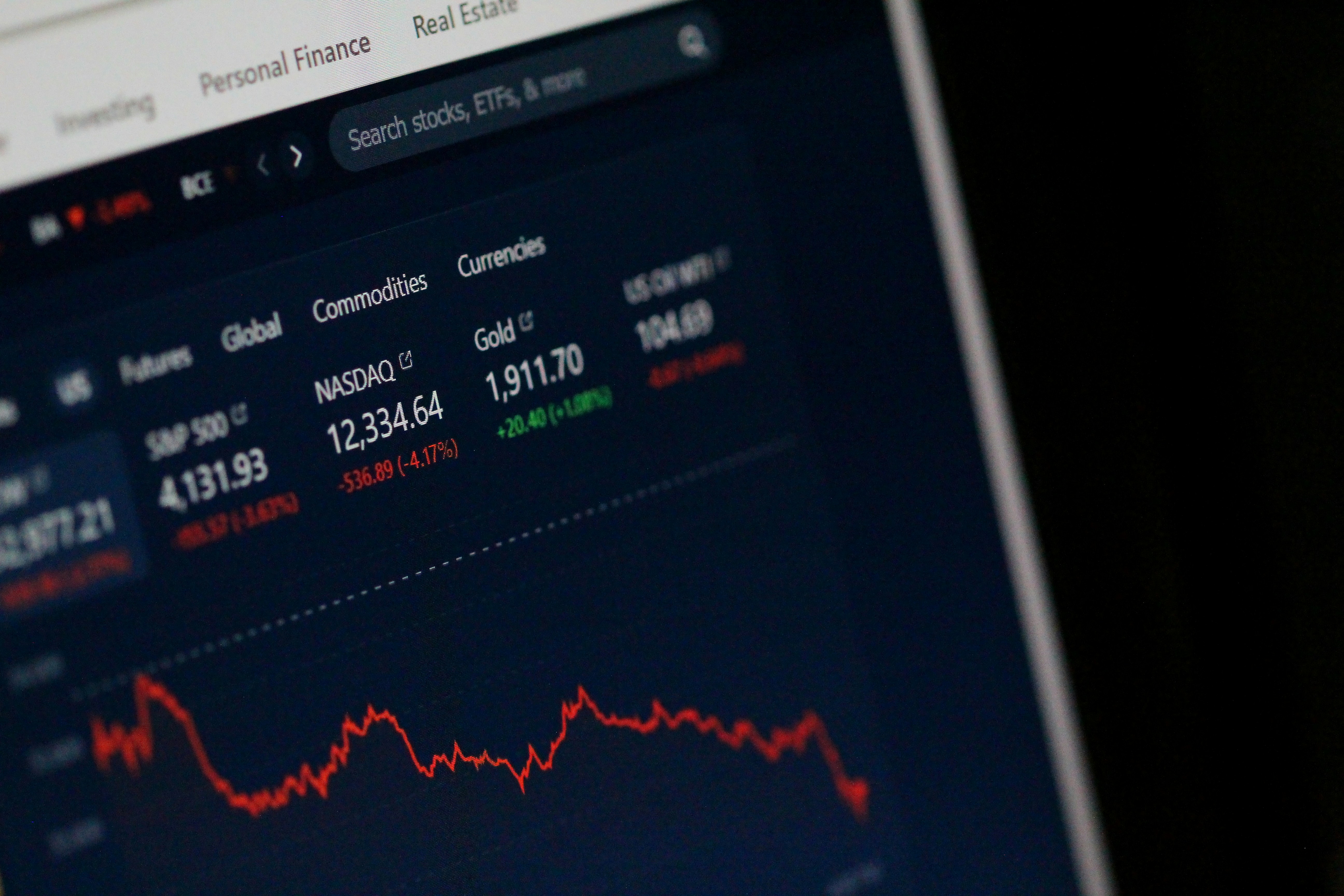

The majority of Asian equities fell on Friday, with technology-heavy indices suffering sharp losses as profit-taking hit the sector even as encouraging signs regarding interest rate reduction were heightened by weaker U.S. inflation data.

Due to profit-taking, heavyweight technology equities, especially chipmakers and firms exposed to artificial intelligence, had overnight losses on Wall Street that were mainly followed by regional markets. The NASDAQ fell by about 2% as a result.

In Asian trade, U.S. stock futures remained stable as attention shifted to the beginning of the second-quarter earnings season. A number of major banks are scheduled to release their results on Friday.

Stock market losses resulted from traders increasing their wagers that the Federal Reserve would start lowering interest rates in September after June's U.S. consumer price index data came in lower than anticipated.

Asia's tech-heavy indices, which had recently mostly outperformed their regional counterparts, had the worst losses on Friday. This year's significant value meltdown was caused by the industry's strong reliance on profit-taking after the hoopla around AI.

As a result of the impending reduction in interest rates, traders were observed shifting their focus to other economically sensitive industries.

This pattern was exemplified by the 2.2% decline in Japan's Nikkei 225 from its record highs set on Thursday. Compared to the Nikkei, the wider TOPIX, which is far less tech-heavy, dropped 0.9%.

With memory chips causing major SK Hynix to lose more than 3%, South Korea's KOSPI fell 1.4%.

The largest contract chip manufacturer in the world, TSMC, which was a major factor in the current tech boom, fell more than 4% from all-time highs.

Chinese internet giants Hong Kong-listed Baidu, Alibaba, and Tencent all saw increases of more than 2%, contributing to a 2% increase in the Hang Seng index. A two-month low that was reached earlier this week was also further distanced from by the index.

The Shanghai Composite Index and the Shanghai Shenzhen CSI 300 indices were flat on Friday, with Chinese markets declining less than their international counterparts.

(Sources: investing.com, reuters.com)