Visa Stock Analysis: Is Visa a Strong Opportunity Ahead of Q4 Earnings?

$325.48

28 Jan 2026, 19:25

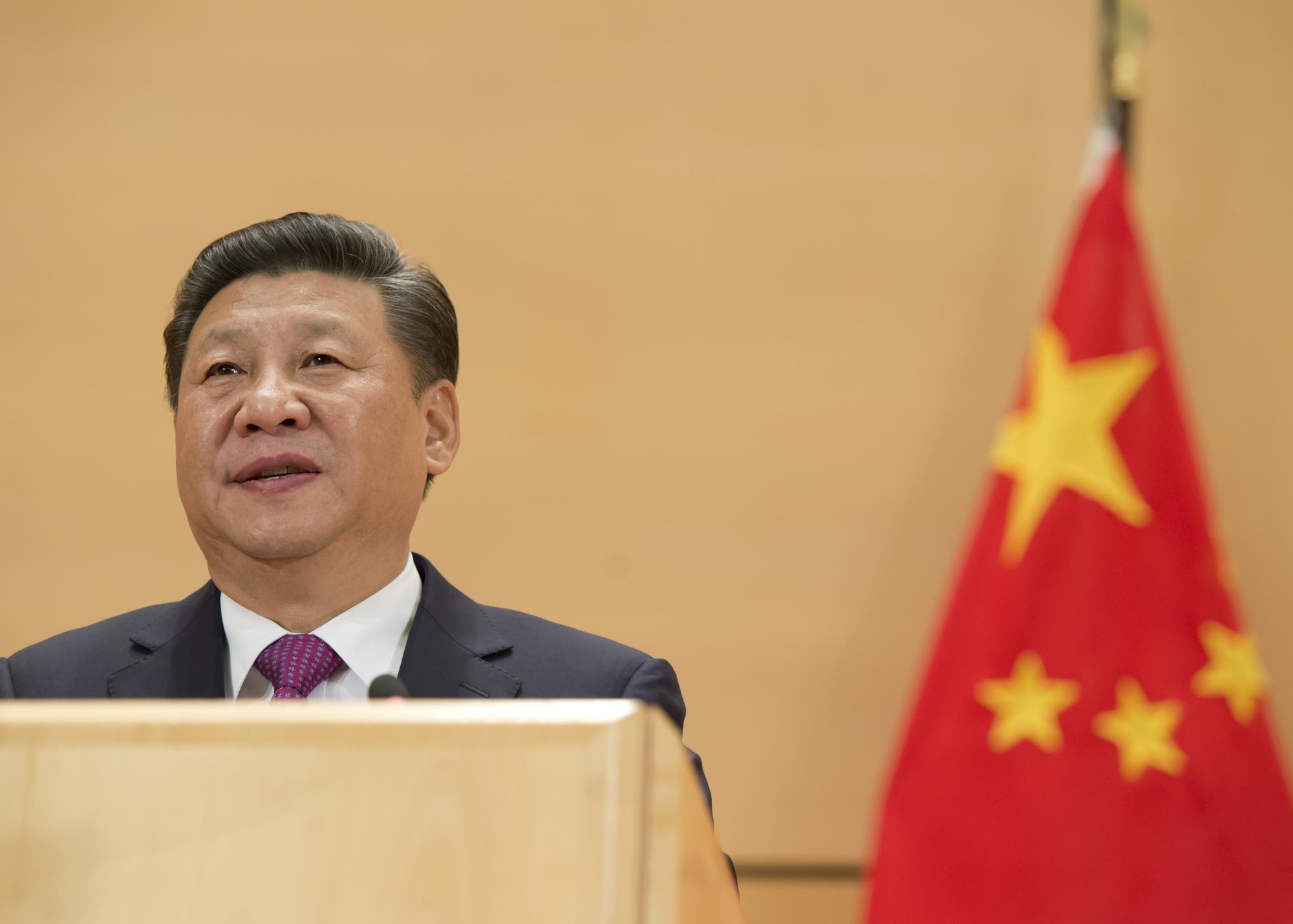

China’s twentieth Communist Party Congress began on 16 October 2022, with President XI Jinping giving an almost two hour long speech to the congress. He laid out his vision for the next five years as he is expected to formally return to power this week and extend his rule. Over 2,000 delegates gathered in the Great Hall of the People in Tiananmen Square.

Economy:

China’s economy has begun to slow, still affected by Xi’s “zero Covid” policy and subsequent lockdowns. China’s state banks have intervened to defend a weak yuan, with Reuters reporting banks sold a high volume of US dollar and uses a combination of swaps and spot trades. The yuan is down 11.6% versus the dollar this year, trading at around 7.1980 per dollar (as of 17 October). The central bank kept interest rates unchanged for a second month, signalling they are continuing a loose monetary policy.

In his speech, the President promised to step up regulation on income distribution and wealth accumulation to address the country’s inequality gap. He is still committed to his zero Covid policy, stating China’s “all-out people’s war on the virus” as a success. He said the people’s health and safety had been protected to the greatest extent possible.

Additionally, he pledged innovation and investment in key technological areas to “achieve greater self-reliance.” This is necessary for China in the face of US sanctions and restrictions on Chinese tech manufacturing. Earlier this month, the US Commerce Department announced regulations that limit the sale of semiconductors and chip-making equipment to Chinese customers. Xi promised to “resolutely win the battle in key core technologies”.

From a trade and investment perspective, the implication of a strengthening in the tech sector and more supportive tech policies is promising. But China’s Covid policy is seen by many as a drag on the economy. The Shanghai Composite Index lost more than 5% over the past month, its worst pre-Congress showing since the gauge’s inception in 1991.

Taiwan, Hong Kong and National Security:

The President praised the CCP’s intervention on Hong Kong, saying that it had achieved a “major transition from chaos to governance” and “order has been restored in Hong Kong.” As for Taiwan, he did not make any significant change from the current position, which is that China seeks “peaceful reunification” but will use force if necessary. He also added that the party will “respect, care and work to benefit compatriots in Taiwan” with economic and cultural exchanges, and rejected foreign intervention on the issue. Taiwan is de facto an independent state, but the Chinese government has always maintained it is part of its territory. Taiwan remains firm that it will not back down on its sovereignty.

Xi emphasised strengthening national security in various dimensions - military, energy, food and supply chain security. He spoke of the need to modernise national security, as it is the “foundation of national rejuvenation” and this was key to ensure social stability. According to a Reuters count, Xi used the terms “security” or “safety” 89 times in his speech, up from 55 times in 2017. ChiNext had a strong bounce last week as the market believes China will pour more investment into national security.

Chinese trade and economic data is expected to be released later this week amidst the Party Conference, and the markets will surely react to the new data. Economists predict third-quarter GDP growth up from the previous quarter, but a poor year overall for China’s growth in the last few decades.

(Sources: Reuters, Bloomberg, The Guardian)