Is US Exceptionalism Fading? Investors Shift Focus Amid Global Market Shifts

For decades, the United States has been the epicentre of global finance, a beacon of economic strength, and the go-to destination for investors seeking stability and growth. However, recent trends suggest that this long-held belief in US exceptionalism may be under pressure.

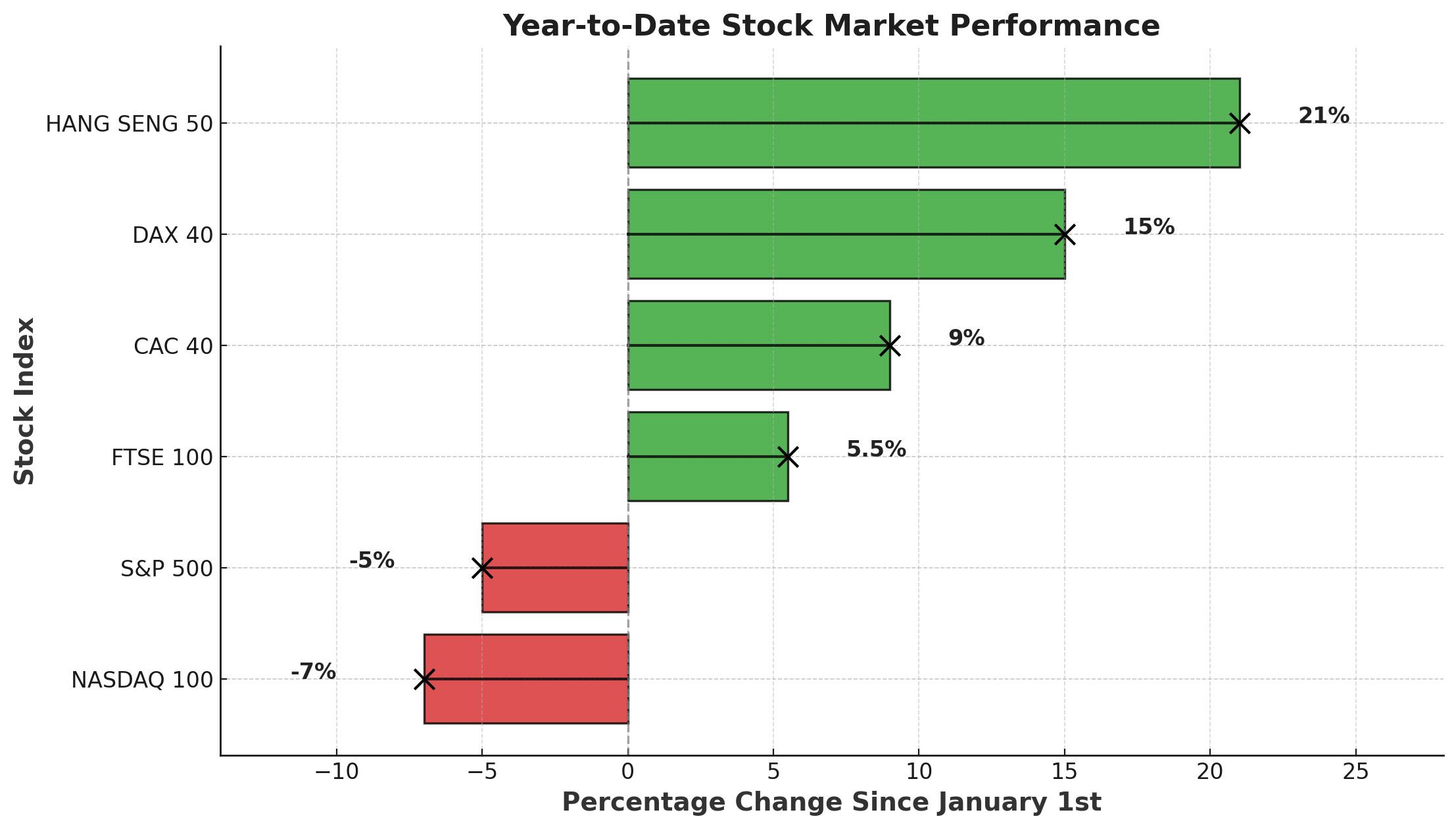

Global Markets Outpacing the US

So far in 2025, both Europe and China have outperformed the US in several key economic indicators, raising questions about whether the world’s financial dominance is shifting.

- Eurozone Resilience: Despite facing headwinds from inflation and energy costs, European stock markets have surged, with the Euro Stoxx 50 outperforming the S&P 500 in recent months. Countries like Germany and France have seen strong economic activity, largely driven by the tech, luxury, and green energy sectors.

- China’s Market Comeback: While China struggled with post-pandemic economic sluggishness, its aggressive stimulus measures and the loosening of regulations on the tech sector have sparked renewed investor confidence, boosting the Hang Seng Index and Shanghai Composite.

- BRICS Strength: Emerging markets, particularly India and Brazil, have also gained traction, attracting investment flows that traditionally favoured US assets.

Smart Money Leaving the US?

A growing number of investors have begun to diversify away from US markets, citing concerns over:

- Recession Risks: The Federal Reserve’s cautious approach to cut interest rates alongside with Trump's tariff war, risk of recession is on the rise.

- Debt and Deficit Worries: The US national debt has exceeded $34 trillion, raising questions about long-term sustainability.

Wall Street's Optimistic Take

Despite the cautious outlook, some Wall Street analysts remain bullish on US markets for 2025. Key reasons include:

- AI & Tech Boom: The US remains the undisputed leader in artificial intelligence and next-generation technologies, with companies like Nvidia, Microsoft, and Alphabet leading innovation.

- Resilient Consumer Spending: Despite higher interest rates, consumer demand remains strong, supporting corporate earnings.

- Rate Cut Expectations: The Federal Reserve may pivot to rate cuts in late 2024 or early 2025, which could ignite another rally in equities.

Conclusion: A Turning Point for Global Finance?

As smart money reallocates funds, the question remains: Is this the end of US exceptionalism, or merely a cyclical shift? While global markets gain ground, the US still holds considerable financial clout. Investors must navigate carefully, balancing short-term risks with long-term opportunities in an evolving economic landscape.

Possible Investment Strategy for 2025 Amid Market Turmoil

Given the shifting global financial landscape, investors should adopt a balanced, adaptive, and globally diversified strategy to hedge against uncertainty while capturing growth opportunities. Below is a multi-pronged investment approach based on current trends:

1. Diversify Beyond the US – Capture Global Growth

With the US facing recession risks and underperformance, allocating capital to strong-performing global markets is a key strategy.

Increase Exposure to Europe & Asia:

- Europe: Benefiting from a rebounding manufacturing sector and strong tech & luxury markets. ETFs like VGK (Vanguard FTSE Europe ETF) or IEUR (iShares Core MSCI Europe ETF) can provide broad exposure.

- China & India: China’s stimulus policies and India’s rapid economic expansion make them attractive. Look into FXI (iShares China Large-Cap ETF) or INDA (iShares MSCI India ETF).

- Latin America & Emerging Markets: Brazil and Mexico’s commodity-driven economies may thrive amid inflationary pressures. Consider EEM (iShares MSCI Emerging Markets ETF).

2. Defensive US Plays – Protect Against Recession Risks

While the US faces headwinds, certain sectors remain resilient.

Defensive Sectors to Focus On:

- Healthcare: Essential services and biotech innovation remain recession-resistant. Consider XLV (Health Care Select Sector ETF) or VHT (Vanguard Health Care ETF).

- Consumer Staples: Companies like Procter & Gamble, Coca-Cola, and Unilever perform well during downturns.

- Utilities: Reliable dividends and low volatility make DUK (Duke Energy), NEE (NextEra Energy), and similar stocks solid picks.

3. Tech & AI Exposure – The Long-Term Growth Bet

Despite volatility, AI, cloud computing, and automation continue to drive innovation.

US Tech Giants:

- AI leaders (Nvidia, Microsoft, Google) are key holdings, but valuations remain high—dollar-cost averaging (DCA) is advised.

- Consider ETFs like QQQ (Invesco Nasdaq-100 ETF) or VGT (Vanguard Information Technology ETF) for diversified exposure.

Cybersecurity & Cloud Computing:

- Companies like CrowdStrike (CRWD), Palo Alto Networks (PANW), and Amazon Web Services (AWS via AMZN stock) are essential in the digital economy.

4. Commodities & Hard Assets – Inflation Hedge

With inflationary pressures still looming, commodities and alternative assets offer a hedge against monetary debasement.

Gold & Silver:

- Central banks worldwide have been increasing gold reserves. ETFs like GLD (SPDR Gold Shares) or SLV (iShares Silver Trust) provide exposure.

Energy & Renewables:

- Oil & Natural Gas: ExxonMobil (XOM), Chevron (CVX) remain key players.

- Clean Energy Boom: Consider ICLN (iShares Global Clean Energy ETF) for renewables exposure.

Final Thoughts: Adopt a Dynamic Investment Mindset

Actionable Strategy Summary:

- Potentially reduce overexposure to US equities and diversify into Europe, China, and emerging markets.

- Focus on defensive sectors, tech innovation, and commodities for balance.

- Consider alternative assets for additional hedging.

- Stay agile—reassess positions quarterly based on global trends.

(Sourced: generated with support from AI)