Visa Stock Analysis: Is Visa a Strong Opportunity Ahead of Q4 Earnings?

$325.48

28 Jan 2026, 19:25

Pexels.com

Ukraine’s Rich Mineral Reserves Draw Global Interest

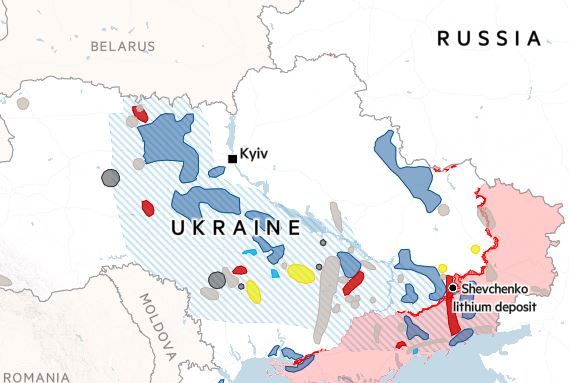

Ukraine is home to vast mineral deposits worth an estimated $11.5 trillion, including lithium, titanium, and rare earth elements like gallium. These resources are essential for industries ranging from defence to electric vehicle production. However, they remain largely undeveloped, with outdated geological data and a lack of investment slowing progress.

Trump’s “Minerals-for-Aid” Proposal

Former U.S. President Donald Trump has proposed a deal where Ukraine would grant mineral rights to the U.S. in return for past military aid. His offer has ignited global debate, as Washington seeks alternative rare earth sources to reduce reliance on China, the dominant player in the sector.

This move follows Trump’s previous failed attempt to buy Greenland, another region rich in critical minerals. Analysts believe the U.S. is determined to secure strategic mineral supplies to boost national security and economic resilience.

Key Minerals in Ukraine: A Breakdown

The Impact of Russia’s Invasion on Resource Access

A major 20% of Ukraine’s mineral-rich land is now under Russian control, posing further challenges to development. Critical Metals Corp, an Australian mining company, lost access to the Shevchenko lithium deposit in the east due to Russian occupation. However, its Dobra deposit in western Ukraine remains a promising site for future extraction.

The U.S. Demand: A Controversial Trade-Off

Trump has stated that Ukraine owes the U.S. $500 billion in resources, including minerals, oil, and infrastructure, in exchange for past military support. This far exceeds the $69.2 billion the U.S. has provided since 2014.

Ukrainian President Volodymyr Zelenskyy has rejected Trump’s offer, arguing that mineral deals should be tied to future security guarantees rather than past aid. Kyiv is also keen on involving European partners like the UK and Canada in resource development.

Barriers to Mining Development in Ukraine

Despite its rich reserves, Ukraine faces significant obstacles in expanding its mining industry:

European Allies React with Concern

European officials have criticised Trump’s approach, likening it to blackmail and colonial-style resource exploitation. Some argue that Ukraine should negotiate more favourable terms, ensuring resources contribute to post-war reconstruction and security.

Conclusion: What’s Next for Ukraine’s Minerals?

The race for Ukraine’s minerals highlights their strategic value in the global economy. While the U.S. aims to secure key resources, Kyiv must carefully negotiate deals that align with long-term national interests. As the war continues, global investors will be watching closely to see how Ukraine leverages its mineral wealth in the face of geopolitical tensions.

Sources: (FT.com, ChatGPT)