Oracle Share Price Analysis: Bearish Phase, Valuation Signals and Bullish Reversal Outlook

$154.97

04 Feb 2026, 11:45

Minipip

The U.S. presidential election cycle is approaching a pivotal moment on Tuesday, November 5, 2024, with the inauguration slated for January 20, 2025. In addition to the presidential race, voters will elect representatives to Congress, which includes all 435 members of the House of Representatives (elected every two years) and one-third of the Senate (33 members with six-year terms).

This election season took a surprising turn as the Democratic Party shifted from President Joe Biden to Vice President Kamala Harris as its candidate, following Biden’s decision to step down. Harris’s campaign has gained momentum, raising over $300 million in August alone, more than doubling Trump’s campaign contributions during the same period. Overall, Democratic fundraising for August hit $540 million, surpassing the $268.5 million raised by Trump’s campaign committee.

Earlier in the year, Trump appeared to have a strong edge, especially after a failed assassination attempt during his campaign in Butler, Pennsylvania—an event that seemed to galvanize his supporters. Biden’s health issues had also been a factor weighing on his popularity. However, the shift to Harris has introduced new dynamics to the race, making the outcome more uncertain.

Market Impact: How Will Financial Markets Respond to the 2024 Election Outcome?

As the election draws near, market analysts are closely evaluating which candidate might be more favorable for U.S. financial markets. The U.S. budget deficit, now nearing 6% of GDP, is a significant factor in this analysis. The fiscal policies proposed by both Harris and Trump are expected to impact Treasury markets, budget deficits, and bond yields, though in different ways.

Kamala Harris is anticipated to exercise more fiscal restraint, which could support market stability. In contrast, Trump’s proposed tax cuts are expected to lead to higher Treasury issuance, potentially unsettling markets and pushing bond yields upward. While rising bond yields haven’t halted stock market growth in recent years, concerns about a possible recession in 2025 and recent shifts in stock market dynamics, favoring non-tech sectors, make the future less certain.

Key Market Consideration: Divided Government for Long-Term Stability

Ultimately, it’s challenging to determine which candidate will be more beneficial for U.S. financial assets. A divided government, with different parties controlling the White House and Congress, could provide a balance that may benefit U.S. equity markets in the long term. This balance may help manage spending, reduce excessive deficit increases, and keep market volatility in check. As investors anticipate the election results, they are likely to monitor fiscal policies and the potential for bipartisan compromise as key indicators for market performance heading into 2025.

Possible Market Reactions Around the U.S. Presidential Election: Insights from IG Analysts

Stock Market Indices

Historically, the stock market often reacts sharply around major U.S. elections. According to a recent poll by FT Michigan Ross, a Kamala Harris victory could be positively received by the broader market due to her party's generally pro-business stance and investor-friendly economic policies, along with higher public trust in her economic management.

However, certain industries, such as fossil fuels and private prisons, may face challenges under Harris's administration due to her stance on environmental and social issues. In contrast, a Trump re-election could trigger initial market volatility, given his unpredictable leadership style. Yet, if Trump were to implement further tax cuts, this might boost market indices, with sectors like healthcare, infrastructure, and defense potentially benefitting from his policies.

Stock Sector Impact

Healthcare Stocks: The healthcare sector may experience turbulence heading into the election. Harris has expressed support for expanding public health insurance, which could pressure profits for private health insurers. On the other hand, Trump’s commitment to repealing the Affordable Care Act could reshape regulatory frameworks, significantly impacting revenue and profit margins for insurers, hospitals, and pharmaceutical and medical device companies.

Biotech and pharmaceutical companies are likely to keep a close watch on the winning candidate's stance on drug pricing reforms, which could introduce market volatility until a clearer policy direction emerges post-election.

Currency Market Reactions

The U.S. Dollar’s value against major currencies like the Euro, British Pound, Yen, and Chinese Yuan is expected to experience election-driven fluctuations. A Trump victory could drive safe-haven demand for the Dollar, strengthening its value, whereas a Harris win may lead to a softer Dollar. Fiscal spending priorities, trade policies, and foreign relations under the new administration will play a critical role in shaping currency trends.

Commodity Market Forecasts

The oil and gas markets are closely monitoring the election outcome. A Harris win could signal tighter environmental regulations and an accelerated transition away from fossil fuels, potentially weighing on oil and gas prices. Conversely, Trump’s policies are expected to favour expanded drilling and more lenient environmental standards, which could support higher commodity prices.

Agricultural commodities may also see shifts based on trade policies, with Trump’s approach likely to emphasize stricter regulations, particularly concerning trade with China. In addition, many analysts speculate that a Trump presidency could hasten the resolution of the Russia-Ukraine conflict, potentially leading to a surge in oil supply, especially if demand from China, the world’s largest oil importer, remains subdued.

(All of the above data has been sourced via our partners: IG.com, XTB.com)

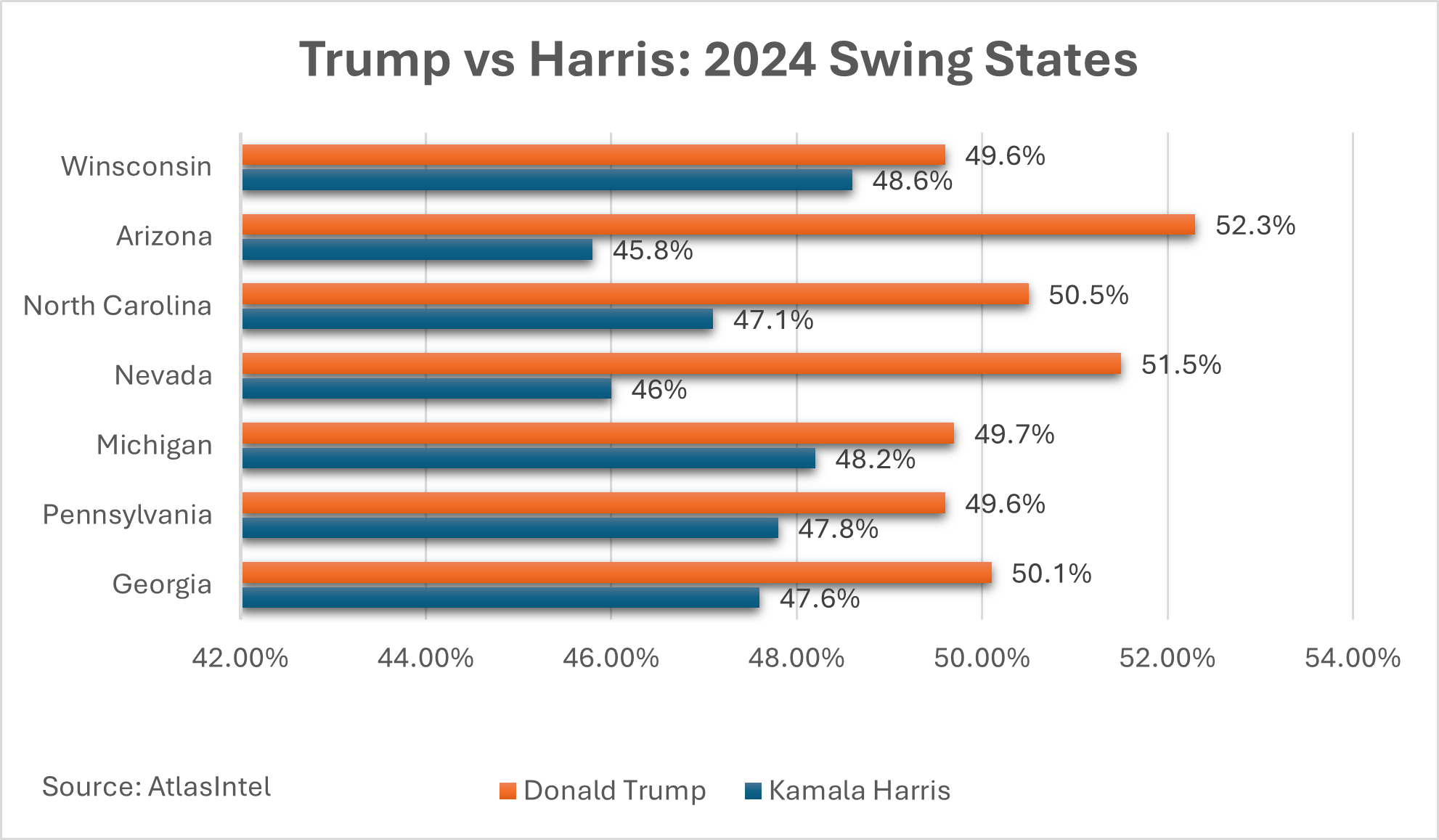

(Data sourced from AtlasIntel.org (Atlas National Poll))

NOTE: Based on the above data, 15.6% of voting/voters are unaccounted for. Suggesting either indecision or uncertainty as the deadline nears, this means the head-to-head race is now much tighter than before.

Key SP500 Support Levels to Watch During and After the U.S. Election

Minipip is closely monitoring crucial SP500 support levels as we approach the U.S. presidential election and the weeks following. Here’s a breakdown of key scenarios and support zones that could shape market direction in the short term.

SP500 Technical Analysis and Key Support Zones

The SP500 has followed a strong supportive trendline since early 2023, reinforcing the bull market through 2024. This trendline currently offers critical support of around 5,650. If the index breaks below this level, traders may look towards the more substantial support near 5,500. This 5,500 zone aligns with multiple technical indicators, including the 200-day moving average, establishing it as a crucial support point.

In Minipip’s assessment, a test of this 5,500 level could serve as a pivotal moment in determining the market’s direction. The clarity in market trends is likely to become more evident once the election results are digested. Here’s Minipip’s outlook for the SP500 over the next 1-3 months, based on key support and resistance levels:

Scenario A: Bearish Case

Scenario B: Base Case

Scenario C: Bullish Case

Each scenario offers insight into potential SP500 movement based on critical support levels, making these areas key to watch during this volatile election season.

(Zoomed Out Chart)

(Zoomed In Chart)