General Dynamics (GD) Fundamental and Technical Stock Analysis: Can the Defence Prime Keep Outperforming?

$364.70

04 Mar 2026, 12:54

Applied Materials (NASDAQ: AMAT) – Q3 Earnings Report Preview and Stock Outlook

Applied Materials (NASDAQ: AMAT):

With a Quarter 3 earnings report set to be released at approximately 9PM on Thursday, 13th November, Applied Materials could be primed for a bearish rally. According to a strong analyst consensus, Applied Materials’ Q3 EPS is estimated to be $2.11, representing a 9.05% decrease from 2024’s Q3 earnings report, which presented an EPS of $2.32.

This could leave Applied Materials stock possibly overvalued, since despite weaker earnings expectations, the share price has actually risen from $192.37 last year to $230.97 this year — an increase of 19.56%. This discrepancy may further contribute to potential downside pressure following the upcoming earnings release.

However, Applied Materials still demonstrates strong fundamentals, maintaining a fair-valued P/E ratio of 27.51 and a solid forward P/E of 24.24, creating strong personal price targets of highs at $261.86 (a 13.37% upside) and lows at $245.31 (a 6.21% upside). In contrast, an analyst’s price prediction of $218.78 (a 4.33% downside) highlights ongoing market uncertainty and suggests that the stock may still be overvalued at current levels.

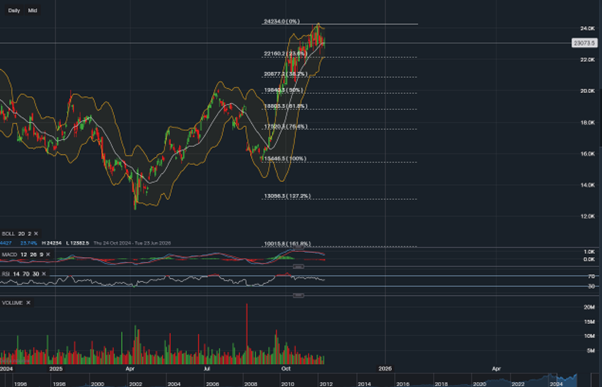

These mixed signals could stem from the general market uncertainty that often precedes earnings announcements. This sentiment can also be confirmed by several technical indicators, including an RSI of 55, a neutral MACD, and price action currently sitting mid-range on the Bollinger Bands, resting near a Fibonacci line at $231.75. Interestingly, one key price zone to monitor is an unclosed fair value gap that occurred on Thursday, 18th September, which could act as a support zone if a bearish move develops. Other notable levels include Applied Materials’ previous highest high of $255.88 on the upside and Fibonacci lines at $221.60 and $208.77 on the downside.

Outlook for traders and investors:

Given the high uncertainty and mixed technical and fundamental signals, it may be wise for traders and investors to monitor further indicators, price reactions, and key support and resistance levels following the Applied Materials Q3 earnings report before making any significant trading decisions.