General Dynamics (GD) Fundamental and Technical Stock Analysis: Can the Defence Prime Keep Outperforming?

$364.70

04 Mar 2026, 12:54

Foot Locker Inc - Chart & Data from IG

Overview

Foot Locker Inc is an American footwear and sportswear retailer. The company currently operates in 28 different countries. Its headquarters is based in Midtown Manhattan, New York City.

Financials

Comparing the year-on-year financials ending in January 2022 to January 2020. In 2022, revenue rose by $1.4 billion and gross profit rose by $900 million. After taxes and operating expenses, net income totalled $892 million, which is a $569 million increase from the previous year. Additionally, EBITDA jumped by 120% and earnings per share spiked 181% year-on-year. Furthermore, total liabilities increased by $625 million, however, total assets rose by $1,092 billion, offsetting the rise in liabilities. Due to this, shareholder equity rose by $467 million YoY.

Technicals

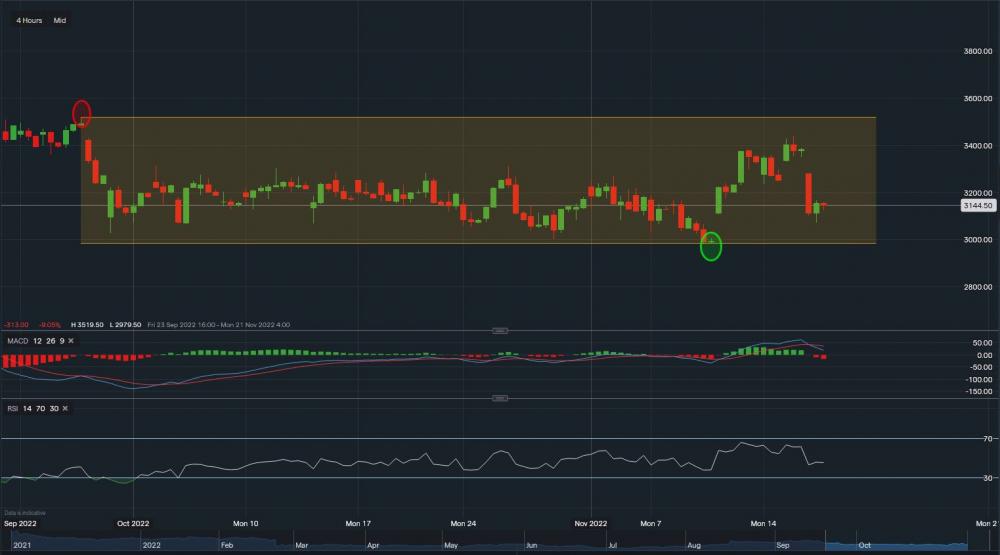

From a technical aspect, Foot Locker’s shares are currently trading at $31.44 a share. Towards the upside, minor resistance sits at $31.66, then further resistance levels sit at $32.21 and $33.10. A break above these levels in the short/mid-term could see the share price hike towards the key resistance level at $35.19 (red oval). On the other hand, towards the downside, minor support sits at $31.28 followed by support at $30.71 and at $30.28. A break below these support levels may see the share price slide towards the major support sitting at $29.85, which is highlighted by the green oval. Looking at the indicators, MACD is currently negative and RSI is neutral as it reads 45.

Summary

Based on Foot Locker’s financials, stability and growth exist. Revenue and profit have grown steadily YoY, and assets outweigh the liabilities relieving some of the pressure from debt. EBITDA and EPS saw a huge hike compared to the previous year, leaving shareholder equity at $3,243 billion which was a $467 million increase YoY as mentioned above. Based on the technicals the movement seems flat, swaying more towards the bearish side. However, Foot Lockers is set to report quarterly earnings tomorrow. It is expected to report earnings of $1.14 a share on revenue of $2.1 billion. A stronger-than-expected report could boost the share price higher, whereas a weaker report could force it towards the major support level.